Sarah Mitchell

times

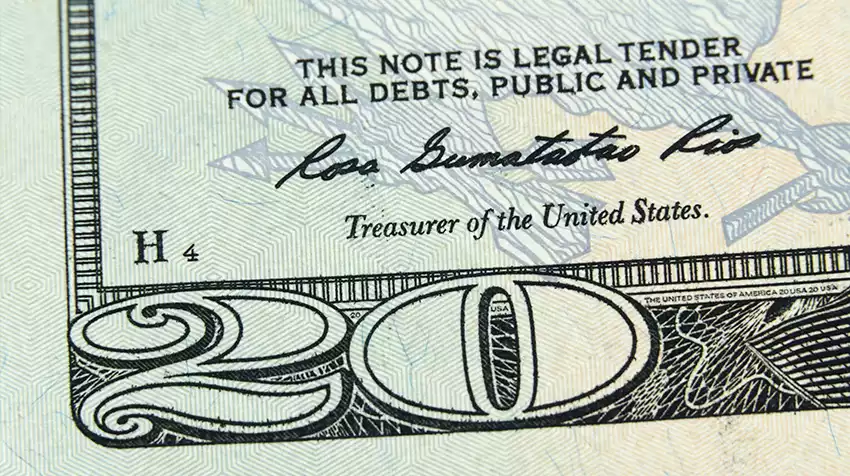

If the word "budget" makes your eyes glaze over, try this instead: save $20 a week.

That’s it. Twenty freaken’ bucks.

The $20 Rule is about consistent, bite-sized action that doesn’t feel like deprivation but adds up in a powerful way over time.

Skip one takeout meal. Swap name brands for generics. Cancel one underused subscription. Whatever.

These tiny tweaks can free up $20 each week. The beauty is that it’s achievable, realistic, and repeatable.

Over a year, that’s $1,040 saved. But more importantly, it builds a habit. You start noticing how easy it is to save small amounts and how quickly they accumulate. The real value of the $20 Rule isn’t the number—it’s the behavior it encourages.

Use a savings app like Qapital or Chime to automate this process. Or set up a recurring weekly transfer to a high-yield savings account. When it happens in the background, you won’t even miss the money, and you’ll be surprised how quickly your account grows.

Want to accelerate things? Apply the same rule in multiple areas. Save $20 on groceries by meal planning. Save $20 on entertainment by swapping a movie night out for a free one in. Use cashback apps to squeeze an extra $20 from everyday purchases.

It’s also a great entry point to bigger financial habits. Once saving becomes second nature, you’ll find it easier to build toward investing, debt repayment, or emergency fund goals. The $20 Rule is like training wheels for your financial life—it helps you build momentum in small, confidence-boosting steps.

Think about it this way: most people don’t fail to save because they don’t make enough—they fail because they don’t start. The $20 Rule gives you a place to start without overwhelming you.

Small change isn’t just coins in your couch cushions. It’s the beginning of lasting financial change—twenty bucks at a time.